This Diwali has brought not only lights, sweets, and celebration, but also a surprising announcement from the Indian government. In a move that has sparked curiosity, debate, and even some speculation, the Reserve Bank of India (RBI) has officially released a brand new ₹5000 currency note. The decision marks a significant development in India’s monetary system, coming years after the demonetisation event of 2016, which saw the discontinuation of the ₹1000 and old ₹500 notes. But what does this new note mean for you and the economy? Let’s break it down.

Why This Move Now

The timing of this release right during the festive season has raised several eyebrows. Diwali is traditionally a time of high consumer spending, large-scale gifting, and cash-based transactions. Experts believe this launch was timed to ensure smooth liquidity during this period, as demand for cash typically surges. However, beyond the festive connection, the introduction of the ₹5000 note may also reflect the government’s intention to streamline high-value transactions and reduce pressure on lower denomination notes.

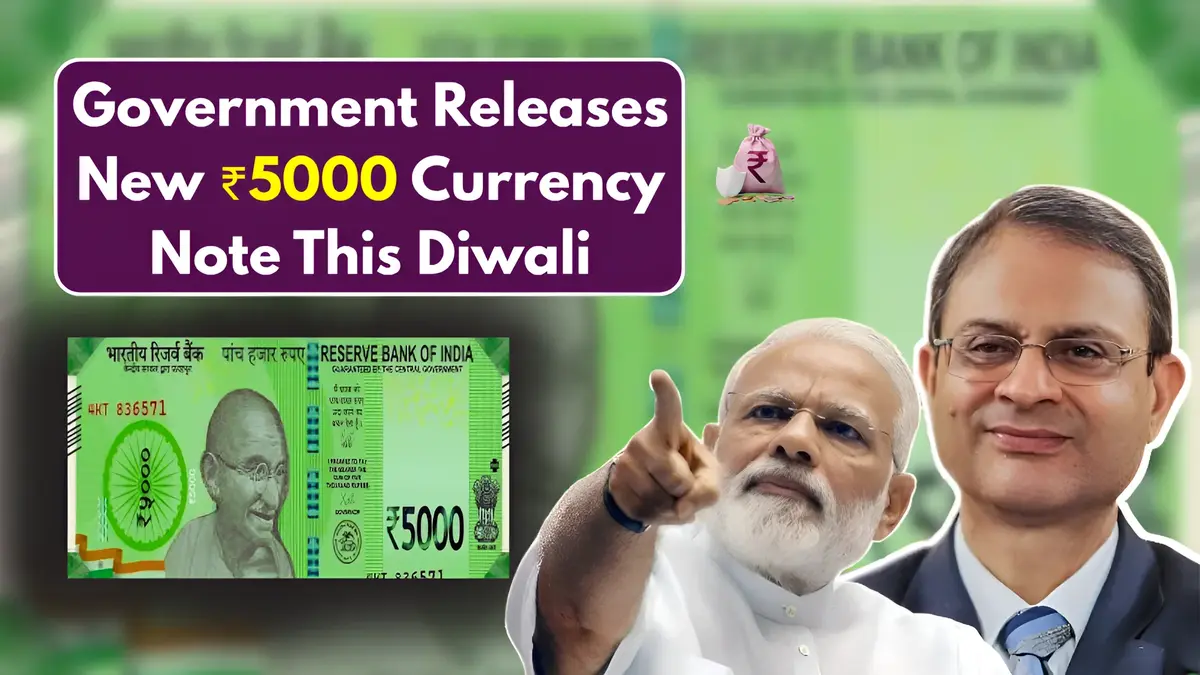

Design And Visual Features

The new ₹5000 note carries a distinct design that blends tradition with modernity. It features a deep saffron base color with hints of gold and blue, symbolizing prosperity and stability. The note displays Mahatma Gandhi’s image on one side, while the reverse features an artistic depiction of the iconic Konark Sun Temple, reinforcing India’s cultural heritage. The size is slightly larger than the ₹2000 note but still compact enough for wallets. The note includes a transparent security thread, watermarks, micro-lettering, and color-changing ink to ensure it’s difficult to counterfeit.

Advanced Security Measures

Security is a major focus in the new note’s design. The RBI has integrated advanced anti-counterfeit features including optically variable ink, a 3D security ribbon, and intaglio printing. There’s also a see-through register and a tactile mark for visually impaired users. The serial numbers have been printed in fluorescent ink, which glows under UV light. All these features aim to ensure that the note remains secure and difficult to replicate, particularly in light of previous challenges with fake currency.

Impact On Daily Transactions

Introducing a higher denomination like ₹5000 may change the way people carry out daily transactions, especially in rural and semi-urban areas where cash remains the primary medium of exchange. For routine purchases, change may become an issue, leading people to continue relying on smaller notes. However, for larger expenses like electronics, jewelry, or bulk purchases, the ₹5000 note could become a preferred option. Small shopkeepers and vendors may initially hesitate to accept the note due to the challenge of providing change.

Digital Economy Versus Cash

In the last few years, India has made significant strides in digital payments, with UPI, QR code payments, and mobile wallets becoming widely accepted. The launch of a high-value currency note at this stage may appear contradictory. However, officials argue that the new note is not meant to replace digital systems but to offer more flexibility. It’s important to note that while urban India is embracing digital payments rapidly, there are still vast areas where internet access is poor, and digital literacy is low. In such areas, a high-denomination note may help facilitate larger transactions without reliance on technology.

Public Response And Reactions

The public’s response has been mixed. Some have welcomed the move, citing convenience and the festive timing. Many business owners are particularly optimistic, hoping it will help manage cash-heavy transactions more efficiently during the Diwali season. Others, however, remain skeptical, fearing that it might encourage black money storage or tax evasion. Social media platforms have been flooded with jokes, memes, and debates, some comparing the new note with past high-value denominations that were eventually discontinued.

RBI’s Clarification On Use

To address growing speculation, the RBI issued a clarification stating that the ₹5000 note is not being launched as a replacement for the ₹2000 note, nor is it a step towards demonetisation. Instead, it is meant to complement the existing currency structure. The RBI emphasized that the new note will be gradually circulated through banks and ATMs, and no immediate changes are expected in daily banking operations. Banks have been instructed to recalibrate their machines and train staff accordingly to handle the new note.

Concerns About Hoarding

One concern that has surfaced is the potential hoarding of ₹5000 notes. In the past, higher denomination notes have made it easier to store large sums of money illegally. To counter this, the government has also introduced a tracking system for bulk withdrawals involving the new note. Financial institutions will be required to maintain transaction records more stringently, especially for cash withdrawals exceeding certain limits. Whether this will be enough to prevent hoarding remains to be seen.

Role In Economic Planning

From a macroeconomic perspective, the introduction of this note may signal a shift in monetary strategy. Some analysts view it as a preparatory step toward future currency reforms or inflation adjustments. Others argue that it’s a move designed to manage the cash economy better without disrupting the growing digital landscape. By giving people more options for high-value cash transactions, the government may be attempting to balance both modern and traditional systems of exchange.

What Happens Going Forward

As with any major change, the success of the ₹5000 note will depend on how it is implemented and accepted across the country. Banks will play a crucial role in ensuring smooth circulation, educating the public, and managing supply. For the general public, the note presents a mix of convenience and caution. Over time, people will adapt to its presence, just as they did with the ₹2000 note years ago. However, the government and RBI must remain vigilant against misuse and ensure that the note serves its intended purpose without encouraging malpractice.

Final Thoughts

The release of the ₹5000 note this Diwali adds an interesting twist to India’s evolving monetary story. Whether it becomes a staple of wallets or just another short-lived experiment remains to be seen. What’s certain is that its arrival has sparked a fresh round of discussion about how Indians use money, both in cash and digitally. As we celebrate the festival of lights, the new note brings with it both opportunities and questions each waiting to unfold with time.

Disclaimer: This article is for informational purposes only. It does not constitute financial advice. Readers are advised to verify facts independently and consult relevant authorities for official guidance.